Notice: WP_Theme_JSON_Resolver::get_user_data(): Error when decoding a theme.json schema for user data. Syntax error in /home/rushprnewscom-328/public_html/prod/wp-includes/functions.php on line 6114

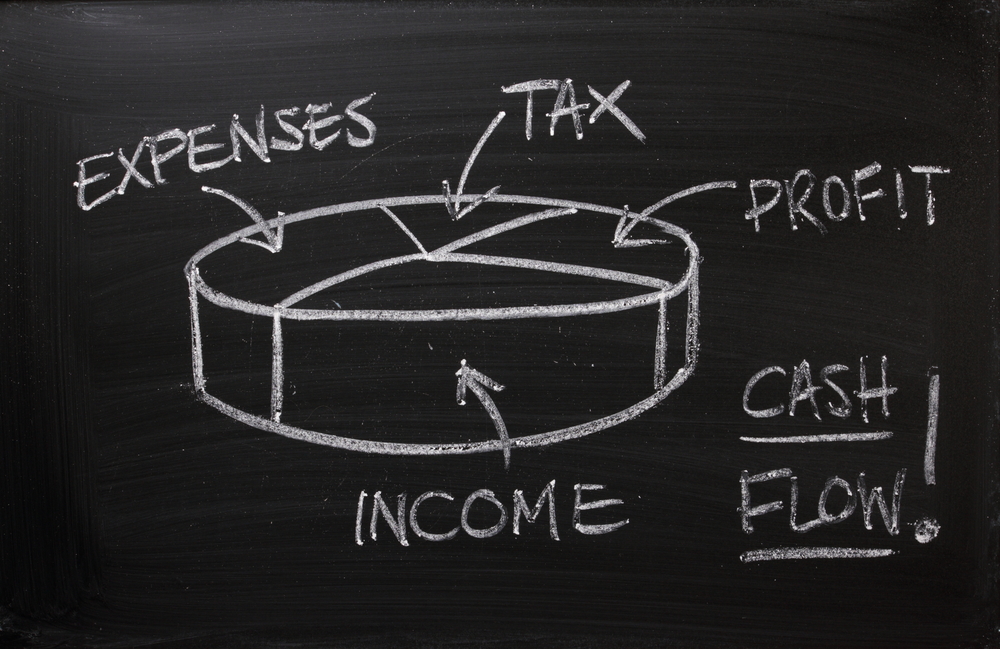

Cash flow is the amount of money coming in and out of a business over a certain period. As a small business owner, you need to maintain positive cash flow. That means your business shouldn’t have unbalanced expenditures.

According to the US Small Business Authority, lack of sufficient cash in a business, which results from poor cash flow management, is the number one reason why most companies fail.

So how do you ensure your business doesn’t run out of money, forcing it to shut down?

10 Cash Flow Management Tips

1. Track Every Cent

If you own an online business, you can consider using simple and reliable accounting software to help you keep track of your money. You’ll need to have proper records of your invoices and all other expenses to see how your money is coming and going.

For instance, you can create a marketing or general business budget to know how much money is going out on a specific day, week, or month.

Do you want to open an online store on the Etsy marketplace or already own one? Check out these steps by Etsygeeks.org on how to open a store on Etsy faster and efficiently.

2. Reduce Unnecessary Expenses

You can check out web traffic Geeks, a website that offers traffic services to online businesses in any niche. If you usually market your products and services on social media, which can be costly, or are looking to cut down on web traffic costs, this company can help you do that efficiently.

Reducing your business costs is an excellent way to ensure that money stays in the business.

3. Credit Line

Having a credit line is an ideal backup plan against money issues for most companies. It is essential because if you happen to run out of money abruptly, you can quickly get a financial boost.

Since money issues are inevitable in any business, having a plan B is always the right way of making sure your company stays alive even during challenging times.

4. Invoice All Your Clients

Invoices are essential for any business. Your company needs accountability, and using invoices for clients is an excellent way of ensuring proper accountability in your firm.

That means it is imperative to make sure that you send all your clients invoices for goods or services delivered to them. To issue invoices efficiently, you can ask your clients their names and addresses so that you can send them invoices each without any confusion.

The benefit of using invoices is that it will provide you with enough information about how much your company is making, thereby enabling you to budget wisely.

When creating invoices for your company, make sure they are simple and have your brand’s name. Invoices also help to create awareness about your brand and show a sign of professionalism.

5. Use Mobile Payment Methods

Mobile payment methods have proven to be quite beneficial for many businesses in today’s world. Without a doubt, technology has taken over, and people nowadays prefer going cashless, as compared to some years back. That has facilitated the wide usage of mobile payments, and most companies have been forced to move with this trend.

As such, mobile payment methods have become alternatives for managing money properly in most companies. This is even more beneficial for people running and selling their products online. That is why it would be essential to integrate mobile payment methods through apps that allow you to get paid faster and have your money instantly once a customer makes the payment.

6. Offer Discounts, Coupons or Free Stuff to Customers

Offering your customers discounts, coupons, or free stuff are effective tactics for enticing them to buy your products or services.

It can also prompt customers to pay faster to avoid losing out on the offer. This can help you ensure that money is always coming into your business, preventing a negative cash flow situation.

Many eCommerce stores have realized such tactics work, and they are maximizing on them to boost their sales.

Other benefits of providing discounts to clients include:

- It attracts more customers.

- You get loyal clients.

- It boosts brand awareness.

7. Request Down Payment for Orders

Requesting down payments for orders is a convenient way of making sure you don’t run out of money. Also, when a client is willing to pay a deposit for goods or services that you are selling to them, it shows a sign of seriousness on their side. This, in turn, helps to keep your business afloat, thanks to the excellent cash flow.

The act of asking for a down payment from a client is not a new thing. This practice has been around for years, and most clients that trust you wouldn’t have a problem putting down a deposit.

For example, you can charge a specific deposit rate to clients for goods or services they want to buy from you. This will give you enough cash for financing the delivery of goods or services, and even enable you to pay employees on time.

8. Don’t Pay or Overpay Suppliers Early

Normalize paying your suppliers when you have all the money to avoid ending up without considerable cash to run the business efficiently.

Unfortunately, some entrepreneurs pay their suppliers and are left without any substantial cash. As a business owner, this is something you need to avoid. Unless there is an important reason you’re supposed to pay the suppliers, try to delay the payment until you’re paid for what you have sold.

You can work out an agreement with your suppliers to pay for goods delivered to your shop at an agreed date or period with a stipulated deadline. When you have this agreement in place, it can help you manage money properly and know the right time to pay the vendors.

9. Have an Emergency Kitty

Emergencies are inevitable, and that means they can happen at any time. The worst thing is getting an emergency and lacking the funds to handle the issue appropriately.

Unfortunately, when some entrepreneurs encounter emergencies, they tend to use all their business’ money. It would be best to keep in mind that your company money is not something to play around with or use in emergency cases.

When you use all your profit on emergencies, this can cause you to shut down the business or stagnate it since there’s no extra money to scale up. That is why to manage cash in your company appropriately; you need to set aside a small kitty for emergencies.

10. Understand the Profits and Losses in Your Business

As the owner of a company, it is your responsibility to understand your profits and losses fully. The reason why knowing how much profit or loss you’ve made in a particular month is that it enables you to understand your company better.

For instance, you get to know the maximum amount of money you’re supposed to spend on your firm’s necessary expenses and how much you can save.

You can save marketing costs if you sell products online and buy fast web traffic from the right website traffic providers to drive more visitors to your website.

Conclusion

Managing money in a small company is something that every entrepreneur needs to take seriously. Your company requires money to run and grow. And that means if you don’t develop an efficient way of managing that cash flow, there is a high chance of making losses and eventually closing down.