The prosecution in U.S. v. Boustani in Brooklyn federal court is running into trouble sustaining its narrative about malfeasance in Mozambique.

It is attempting to show that Jean Boustani, a ship salesman, was the mastermind of sham contracts, hidden loans and a conspiracy. But a government witness this week undercut all of those assertions.

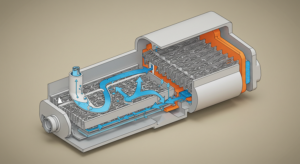

Witness testimony on Thursday dealt a blow to assertions that Boustani, the Lebaneseship salesman, conspired to defraud banks and investors involved in Mozambique’s purchase of ships and related maritime equipment and systems. In fact, as was made clear, the goods and services contracted for were delivered and the Mozambique debts incurred for these projects were disclosed to the banks, investors and even the International Monetary Fund. How could the contracts have, therefore, been a sham or the debts be considered hidden, as prosecutors and others have alleged?

Testimony offered by an official from Credit Suisse, one of the two main lenders forMozambique’s purchase of ships and related equipment, contradicted government claims that there was a conspiracy, that contracts overseen by Mr. Boustani were shams and that debts associated with procurement of the contracted goods and services were hidden.

Like other witnesses in the government’s case against Mr. Boustani, Andrew Burton, a Credit Suisse investment banker and former head of the bank’s liability management, testified that he had never met Boustani. One might ask, Don’t conspiracies need conspirators? On Wednesday, Cicely Leemhuis, deputy general counsel of VTB Bank –the other lender involved in the Mozambique loans – also testified that she had never met Mr. Boustani.

According to Mr. Burton, Credit Suisse, as part of its due diligence in preparation of a 2016 bond transaction it was working on with the government of Mozambique, hired an independent consultant to reevaluate contracts associated with the Mozambique projects initially funded in 2013 by Credit Suisse and VTB. Not only were these projects found to be in proper order, but according to Mr. Burton, parties such as the International Monetary Fund were aware of the loans being made. Shams? Hidden debts? This testimony gives a different version.

Likewise, Mr. Burton made clear how transparent the bond sales associated with the Mozambique loans and maritime projects were. He said any concerns the independent review might have raised were discussed at the highest levels within Credit Suisse and were in line with Credit Suisse’s investment review policies. Credit Suisse, he said, reached the determination that there was no wrongdoing and approved its engagement with the government of Mozambique at every level of internal and external due diligence review.

Further complicating the government’s case, Mr. Burton testified that the “bond exchange, to this day, was a good deal for both the country and the investors.” He said that Mozambique properly disclosed its debt guarantees in a Eurobond exchange circular and that the country’s finance minister, Adriano Maleiane, told a roadshow in New York that Mozambique had every intention of repaying its debts and that the IMF was on board. According to Mr. Burton, neither Mr. Boustani nor anyone else from his employer, Privinvest, attended a roadshow for investors or communicated with any of the investors.

Federal prosecutors are still making their case and they clearly believe they have astrong one. But thus far, they are facing obstacles proving that crimes occurred and that the narrative they started with still has legs.